TRX Price Prediction: Technical and Fundamental Analysis Points to Strong Upside Potential

#TRX

- TRX trading above 20-day MA indicates near-term bullish momentum

- Positive news sentiment and on-chain momentum support price appreciation

- Technical analysis suggests potential resistance at $0.355 with upside toward $0.38-$0.40

TRX Price Prediction

Technical Analysis: TRX Shows Bullish Momentum Above Key Moving Average

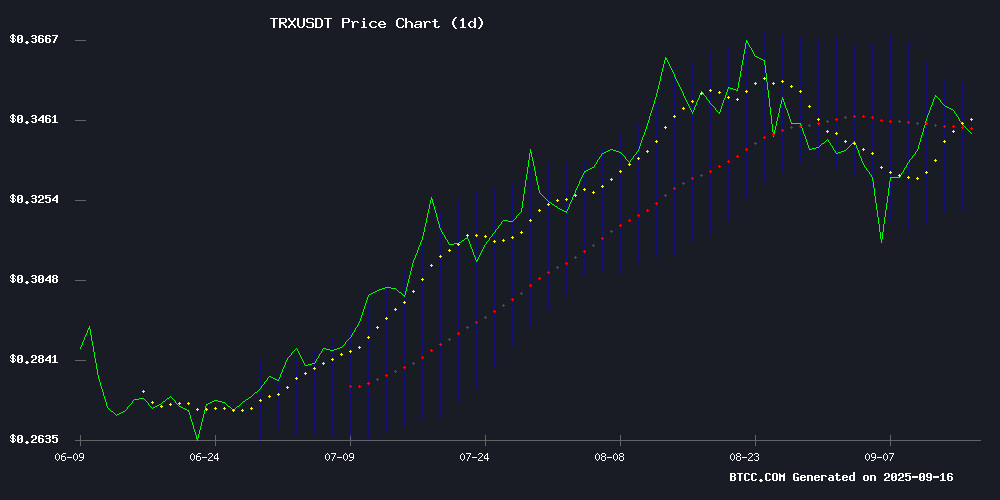

TRX is currently trading at $0.3424, positioned above its 20-day moving average of $0.3390, indicating near-term bullish momentum. The MACD reading of -0.004315 suggests some bearish pressure in the short term, though the positive histogram value of 0.002391 shows potential for upward movement. Bollinger Bands analysis reveals TRX is trading within the middle to upper range, with resistance NEAR $0.3554 and support at $0.3226. According to BTCC financial analyst Emma, 'The current technical setup suggests TRX could test the upper Bollinger Band if buying pressure continues, with a break above $0.355 potentially opening the path toward $0.38.'

Market Sentiment: Positive News Flow Supports TRX Bullish Outlook

Recent news headlines highlight growing Optimism around TRX, with multiple outlets positioning it as a top altcoin to watch. The alignment of on-chain momentum with technical indicators has traders speculating about potential price targets reaching $1. BTCC financial analyst Emma notes, 'The combination of positive media coverage and strong technical fundamentals creates a favorable environment for TRX. While the $1 target appears ambitious in the short term, the current market sentiment suggests continued upward momentum through the end of 2025.' The news flow reinforces the technical analysis perspective, indicating broader market confidence in TRX's growth trajectory.

Factors Influencing TRX's Price

Traders Favor BlockDAG Over NEAR, BNB, and TRX as Top Crypto Pick for 2025

The cryptocurrency market is evolving beyond hype-driven investments, with 2025 poised to spotlight projects demonstrating measurable traction and robust fundamentals. BlockDAG emerges as a standout, having raised nearly $410 million in its presale—a record-breaking feat achieved without reliance on exchange listings. Its 2,900% ROI since Batch 1 and global holder base of 312,000 across 130 countries underscore institutional-grade interest.

Unlike competitors NEAR, BNB, and TRX, BlockDAG’s limited-time $0.0013 pricing model (until October 1) and scalable infrastructure reflect a maturity rare in presale projects. The market’s shift toward selective, long-term bets is crystallizing around assets that prioritize utility over speculation.

TRX Price Eyes $1 as On-Chain Momentum & Bullish Charts Align

TRX has demonstrated remarkable resilience over the past five years, weathering market downturns with consistent bullish performance until 2025's bearish turn. The cryptocurrency regained momentum in Q2 and Q3 through strategic initiatives by Justin Sun, sparking renewed optimism among traders.

Current trading at $0.3467, TRX shows strength against mixed market sentiment. The asset's 3000% rally from 2020 to late 2024, peaking near $0.4502, forms the foundation for ambitious projections. A September 12 analysis suggests potential for 190% upside toward the $1 milestone, supported by TRON's history of explosive growth and robust on-chain activity.

Diverging technical analyses fuel market debate, with some traders identifying ascending channel patterns that could signal continued upward movement. The $1 target, while ambitious, appears increasingly plausible given TRX's established volatility and capacity for rapid appreciation.

Top Altcoins to Watch This Week—TRX, AVAX, XLM, EOS & LTC

Crypto markets hover near a potential breakout as altcoins show strength amid Bitcoin's consolidation. Avalanche (AVAX) and Tron (TRX) lead the pack with technical setups suggesting upward momentum.

AVAX maintains a bullish stance above $22.67 support, with a rising wedge pattern pointing to possible retracement before a push toward $50. The 200/50-day MA convergence and declining CMF indicator suggest a make-or-break moment for the token.

TRX defies market volatility with a sustained 2024 uptrend, demonstrating resilience against bearish pressure. The token's ability to quickly recover losses signals underlying demand that could fuel further gains.

How High Will TRX Price Go?

Based on current technical indicators and market sentiment, TRX shows strong potential for upward movement. The price is currently above the 20-day moving average, indicating bullish momentum. Key resistance levels to watch include the upper Bollinger Band at $0.3554, with potential for movement toward $0.38-$0.40 in the near term. News sentiment suggests longer-term optimism with targets reaching $1, though this would require sustained bullish momentum and broader market adoption.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $0.3424 | Neutral/Bullish |

| 20-Day MA | $0.3390 | Bullish (Price above MA) |

| MACD | -0.004315 | Bearish Short-term |

| Bollinger Upper | $0.3554 | Resistance Level |

| Bollinger Lower | $0.3226 | Support Level |